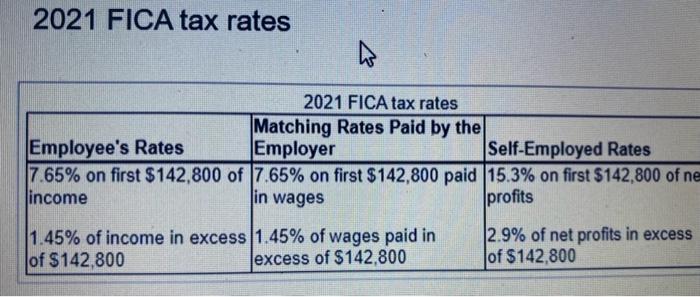

2021 FICA Tax Rates

Por um escritor misterioso

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

FICA Tax: What It is and How to Calculate It

Federal Tax Income Brackets For 2023 And 2024

What are FICA Taxes? 2022-2023 Rates and Instructions

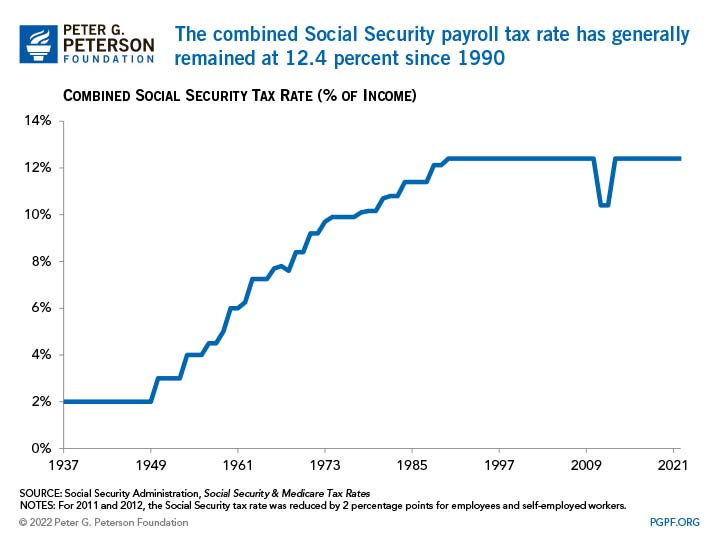

Social Security Reform: Options to Raise Revenues

Payroll Tax Rates (2023 Guide) – Forbes Advisor

The 2021 “Social Security wage base” is increasing - WellsColeman

Inflation Spikes Social Security Checks for 2022 - Baker Holtz

Solved Use the 2021 FICA tax rates in the table below to

Medicare tax: Diving Deep into W2 Forms: Uncovering Medicare Taxes - FasterCapital

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Social Security tax impact calculator - Bogleheads

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

States That Tax Social Security Benefits

de

por adulto (o preço varia de acordo com o tamanho do grupo)