Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Descrição

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

8 Benefits Of Being An Independent Contractor in 2023

Hiring Independent Contractors vs. Full-Time Employees - Pilot

Employee misclassification penalties: Examples and protections

Easy Guide to Independent Contractor Taxes: California Edition

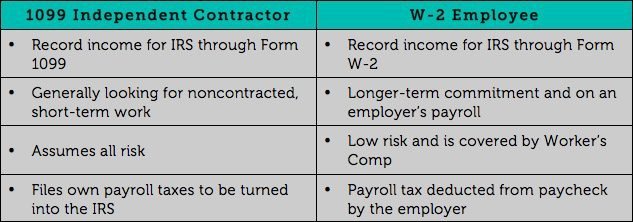

1099 Form Vs W2 Form

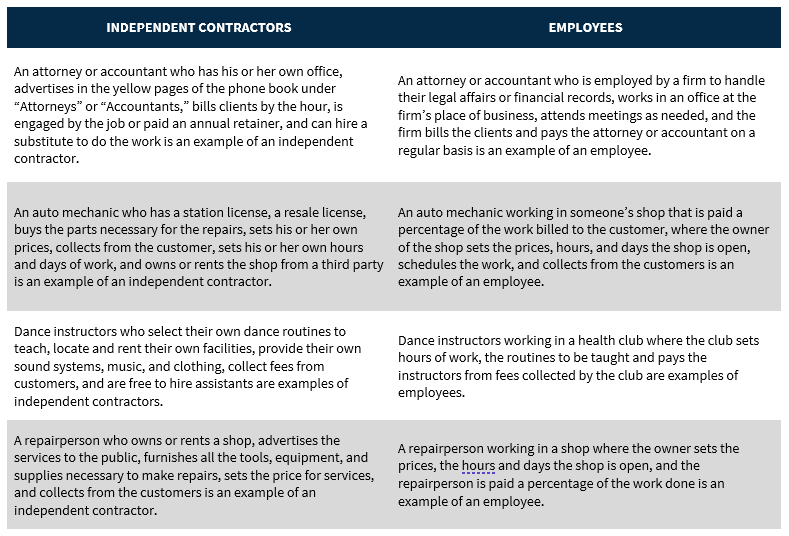

Independent Contractor vs. Employee: How Employers Can Tell the

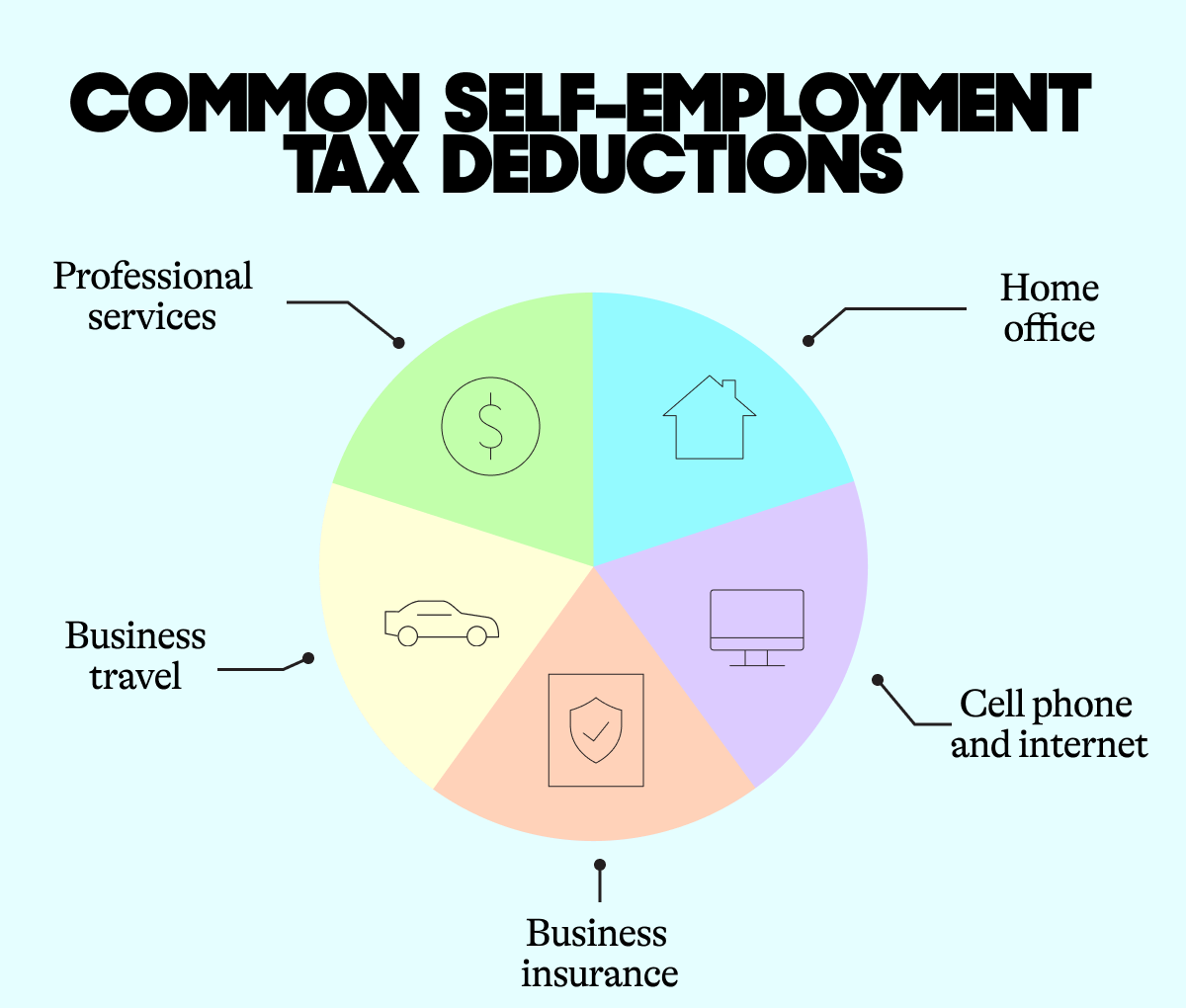

The Independent Contractor Tax Rate: Breaking It Down • Benzinga

Insurance Review of Independent Contractors Risk and Insurance

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

16 Amazing Tax Deductions for Independent Contractors In 2023

A Guide to Independent Contractor Taxes - Ramsey

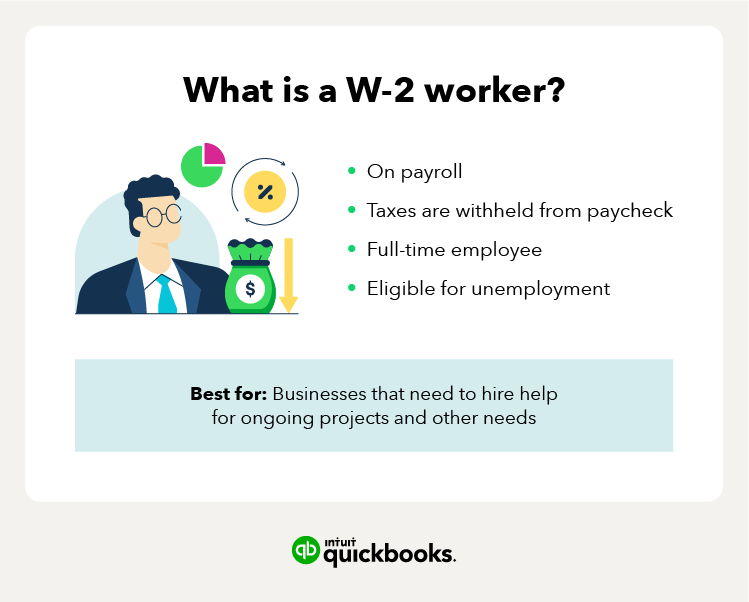

1099 vs W-2: What's the difference?

What's the Difference Between W-2 Employees and 1099 Contractors

How Much Should I Save for 1099 Taxes? [Free Self-Employment

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/dodd-frank-financial-regulatory-reform-bill.asp-final-5ae832d396f345ee8706cdac55670ebf.png)