FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

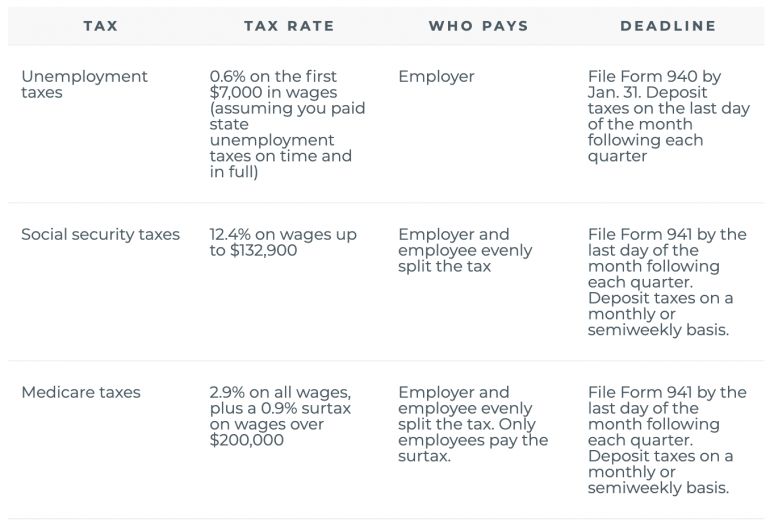

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

Employer Payroll Taxes: What You Need to Know - FasterCapital

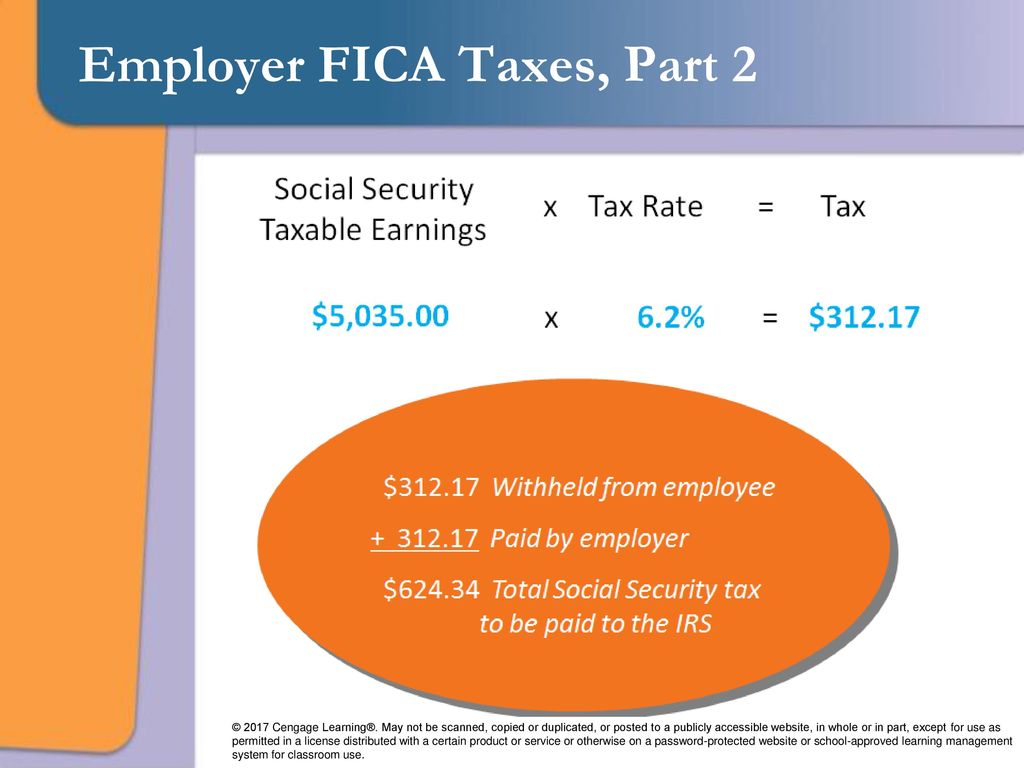

Chapter 9 Payroll Accounting: Employer Taxes and Reports. - ppt download

FUTA vs: FICA: Distinguishing Between Federal Payroll Taxes - FasterCapital

How LLCs Pay Taxes - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

LLC vs. Sole Proprietorship: How to Choose - NerdWallet

Employers responsibility for FICA payroll taxes

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

Smart Money Podcast: Retirement Planning Guide: Estate Planning, Social Security, Long-Term Care and Medicare Explained - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)