Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

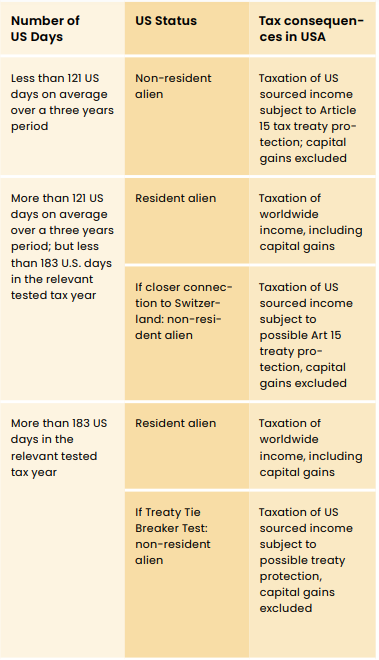

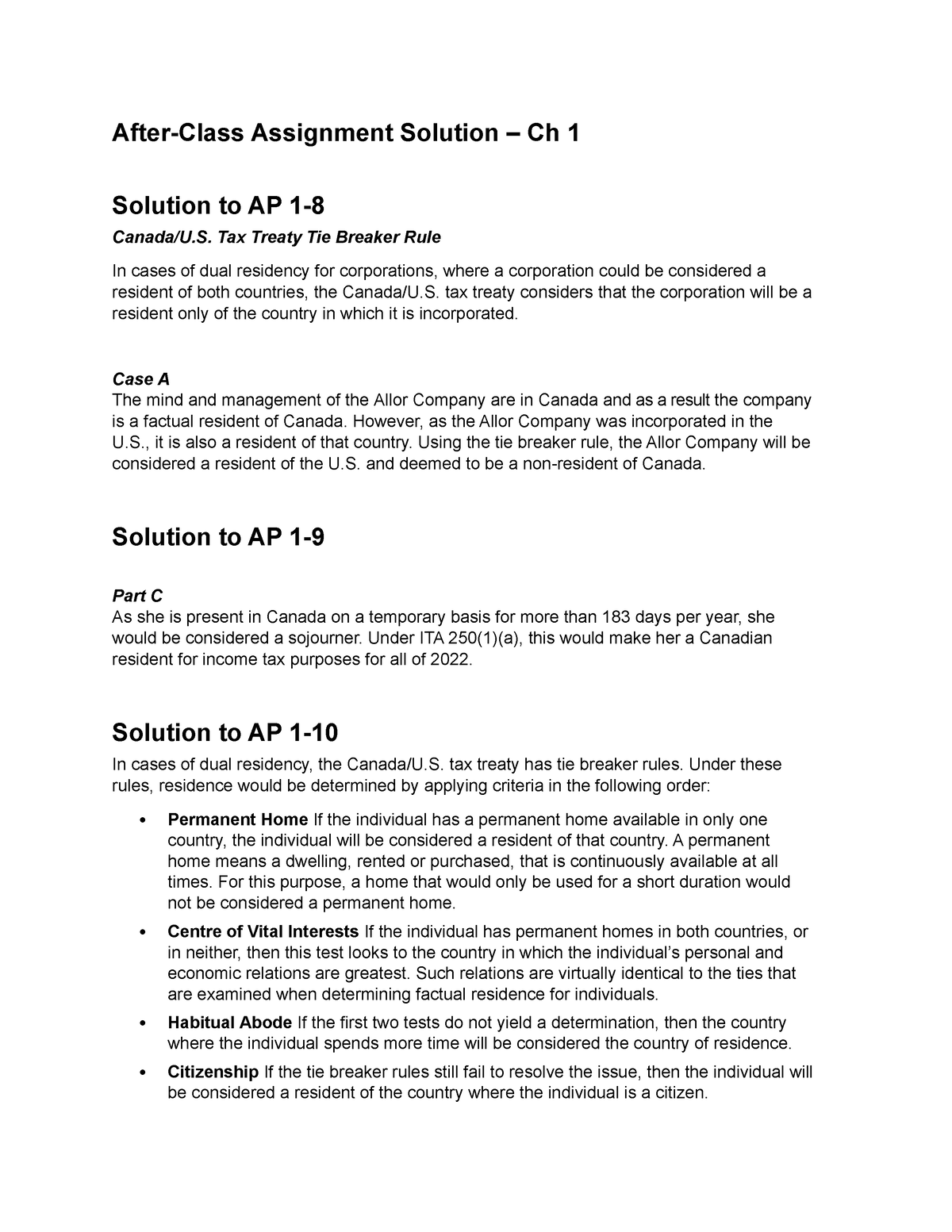

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Tie Breaker Rule in Tax Treaties

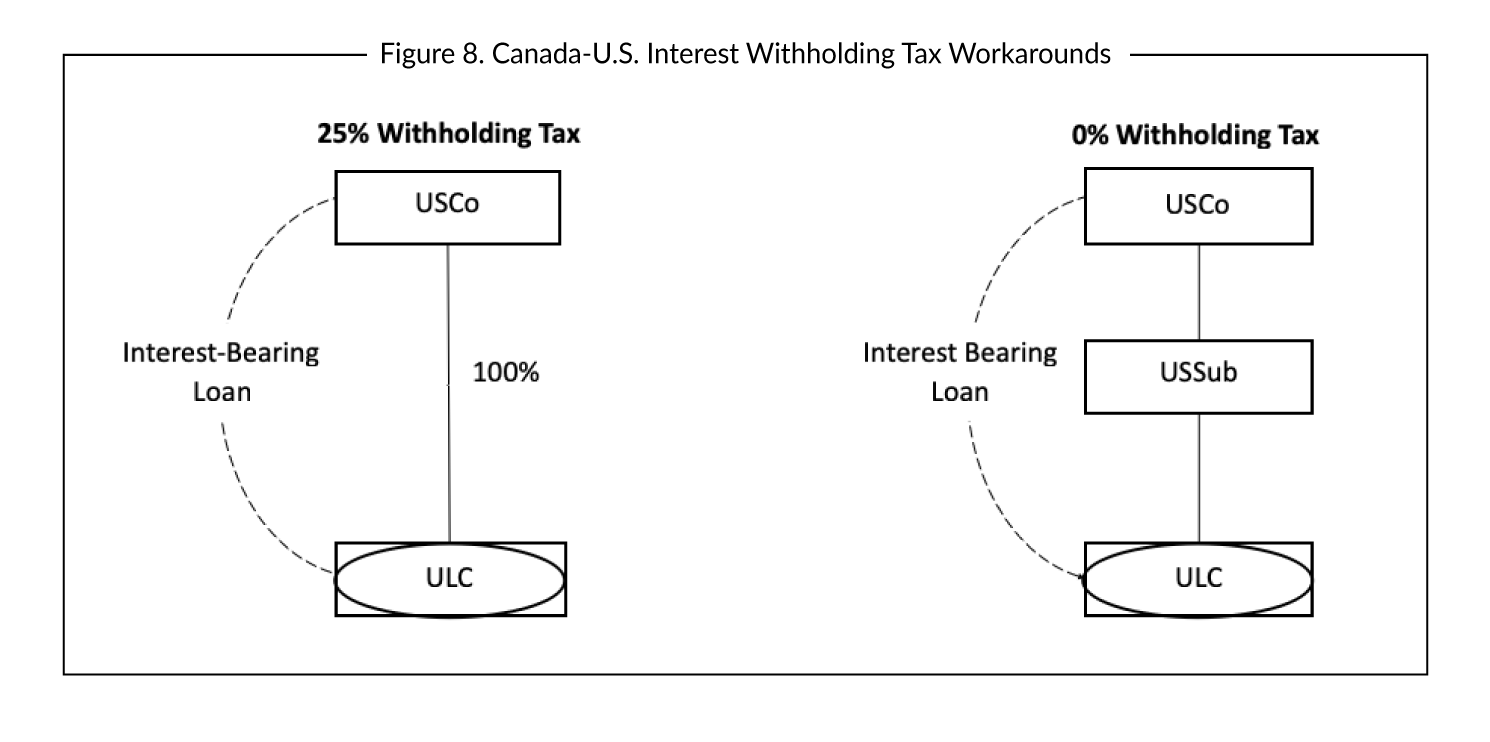

Tax Treaties Business Tax Canada

Residency Tie Breaker Rules & Relevance

Residency Tie Breaker Rules & Relevance

RESIDENCE UNDER TAX TREATIES - ppt download

Canadian Snowbirds and U.S. Income Tax

US-NZ Income Tax Treaty Professional Income Tax Law Advice

Newcomers to Canada Newcomers to Canada. - ppt download

Canada - U.S. Tie breaker rule - HTK Academy

Expansion into the USA: dos and don'ts from a tax point of view - Lexology

Week 2 Ch1 Assignment Solution - After-Class Assignment Solution – Ch 1 Solution to AP 1- Canada/U. - Studocu

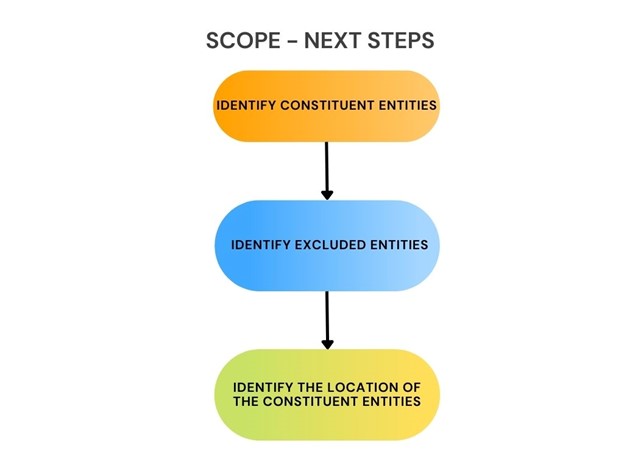

Identify Constituent and Excluded Entities »

Tax Laws for U.S. Green Card Holders

U.S. Tax Residency - The CPA Journal

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/pic966113.jpg)