MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

Chennai tribunal gives split verdict over GST on salaries to expats

19.10.2023: India arms of 1,000 MNCs asked to pay GST on expat salaries, allowances - TaxO

JOItmC, Free Full-Text

GST Evasion: Government expecting ₹50,000 crore mop-up on recovery of dues, multiple notices sent

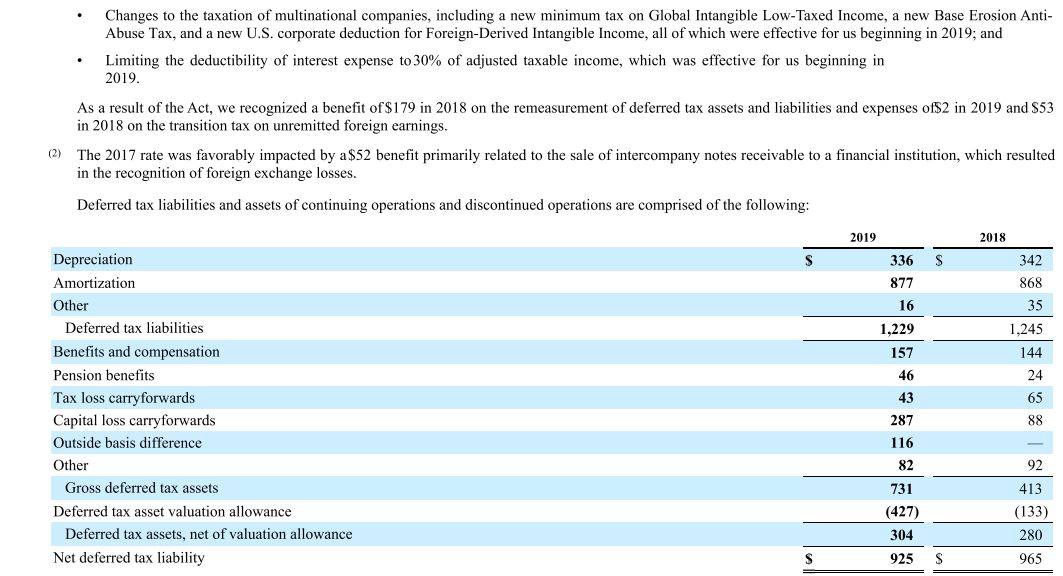

SEC Filing Lockheed Martin Corp

GST Officials Demand 18% GST on Expat Salaries and Allowances from MNCs

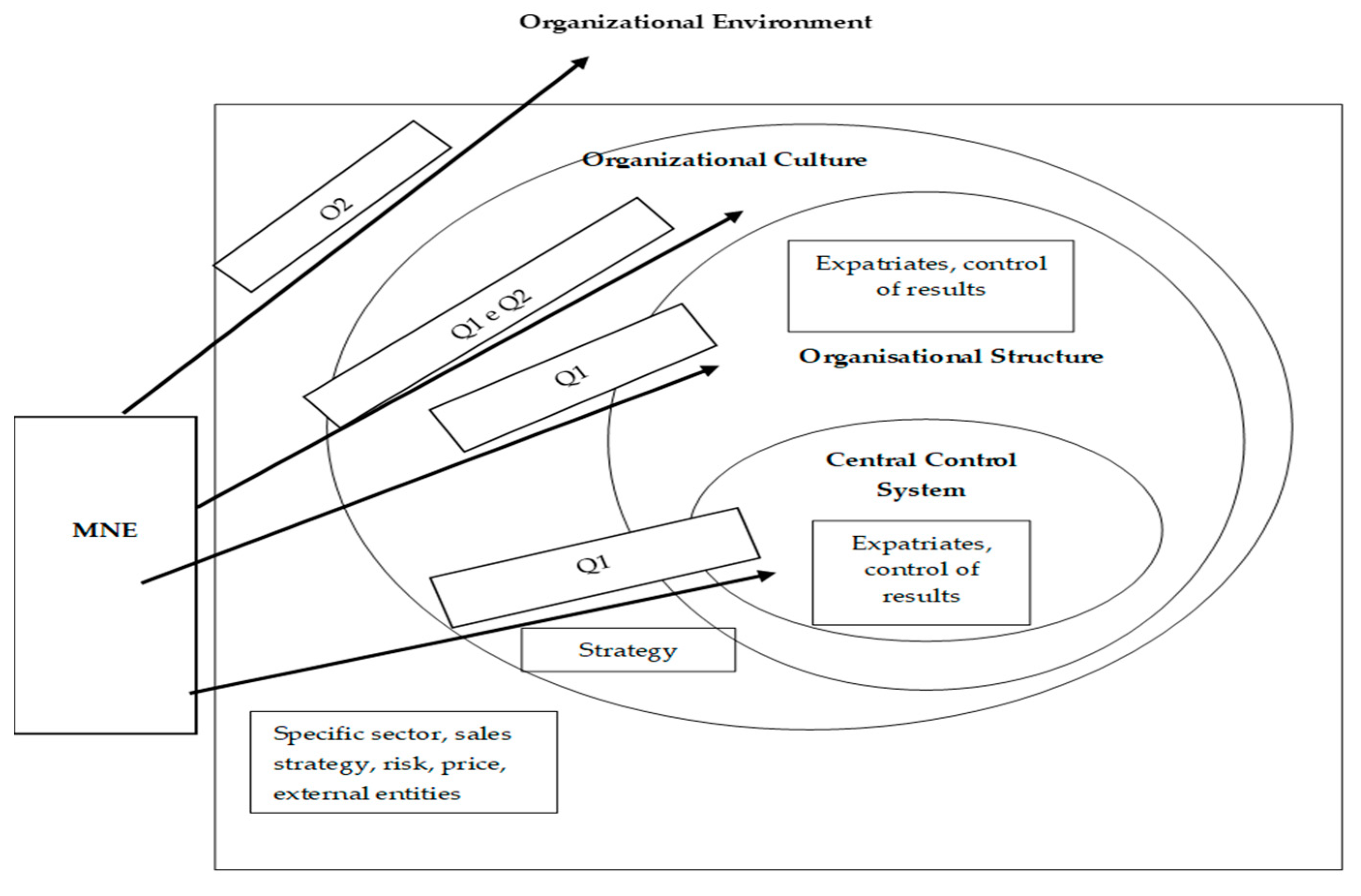

Subsidiary Employees' Triple Allegiance: Differences Between Parent-

View PDF - Fried Frank

Income Tax: note 12 pg 67- 69 What is the effective

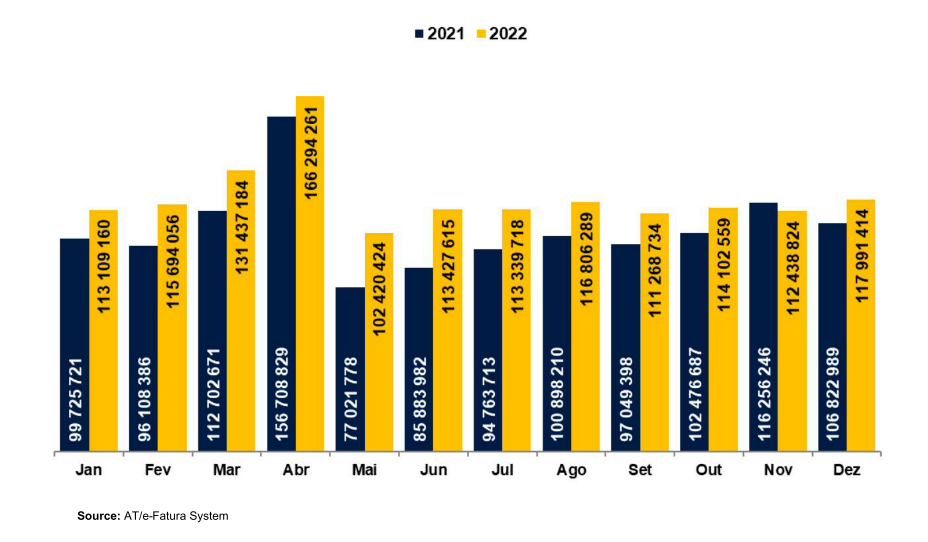

REPORT ON THE FIGHTING FRAUD AND EVASION TAX AND CUSTOMS 2022

Fostering operational management “Best Practices” in subsidiary plants in the Western Balkans: The role of MNC home-country environment and resource allocation - ScienceDirect

de

por adulto (o preço varia de acordo com o tamanho do grupo)